Monday, October 23, 2006

Evidence Toward a Suspicion - People are getting *****ed by their Agents

by Ken Houghton

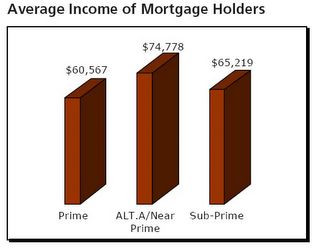

However, at the end of a previous, marvelous survey post, Calculated Risk posts this photo (which I shamelessly mirror here).

Think about this a moment. People with lowest average incomes (which we can reasonably assume to be a proxy indicator that they are the least creditworthy) are receiving less risky loans than their better-compensated peers.

The purpose of an Economic Agent is that they can get a better deal for you than you can get on your own. Here, the Agents are directing customers to take on more risk than they need to, with little to no upside potential.

Sure, the headline is that firms are "relaxing their credit standards." But the reality appears to have been that those with the best credit have been paying more than their optimal cost.

If you only got your information from the WSJ (which article is discussed in both Tom's recent post and the Calculated Risk link to which he refers), you might get the impression that the worst types of loans are being given to the least-qualified buyers.

However, at the end of a previous, marvelous survey post, Calculated Risk posts this photo (which I shamelessly mirror here).

Think about this a moment. People with lowest average incomes (which we can reasonably assume to be a proxy indicator that they are the least creditworthy) are receiving less risky loans than their better-compensated peers.

The purpose of an Economic Agent is that they can get a better deal for you than you can get on your own. Here, the Agents are directing customers to take on more risk than they need to, with little to no upside potential.

Sure, the headline is that firms are "relaxing their credit standards." But the reality appears to have been that those with the best credit have been paying more than their optimal cost.

Comments:

<< Home

I'd followed that link from CR, and wasn't completely clear whether that picture represents U.S. or Canadian data (apparently, Canadians make much less use of nontraditional mortgages than the U.S., U.K., or Australia). Though I wouldn't be surprised at all if something similar held for the U.S., if the picture is of Canadian data.

You have to be a little careful about what is meant by customers taking on "more risk than they need to" -- with the emphasis on "need" -- and on the perception of "upside potential." Some of those upscale home-buyers are being screwed because they bought into the bubble too late, so they may have harbored an irrational expectation (fostered by the lenders) that stretching for some wildly "overpriced" house in a prime location was a perfectly reasonable way to get on the bubble's gravy train.

So the prime question is whether it would be necessary to stretch if buyers' agents put up semi-organized resistance to bubble pricing, as opposed to running up the white flag and cashing in -- or if there was just too much liquidity flowing into the market for resistance to be non-futile.

Post a Comment

You have to be a little careful about what is meant by customers taking on "more risk than they need to" -- with the emphasis on "need" -- and on the perception of "upside potential." Some of those upscale home-buyers are being screwed because they bought into the bubble too late, so they may have harbored an irrational expectation (fostered by the lenders) that stretching for some wildly "overpriced" house in a prime location was a perfectly reasonable way to get on the bubble's gravy train.

So the prime question is whether it would be necessary to stretch if buyers' agents put up semi-organized resistance to bubble pricing, as opposed to running up the white flag and cashing in -- or if there was just too much liquidity flowing into the market for resistance to be non-futile.

<< Home