Friday, August 31, 2007

Least Compelling National Security Rationale Ever

From 9CA, OK'ing the use of high-powered sonar in planned naval training exercises off the California coast:

"The public does indeed have a very considerable interest in preserving our natural environment and especially relatively scarce whales," Judge Andrew Kleinfeld wrote for the majority. "But it also has an interest in national defense. We are currently engaged in war, in two countries."Someday, one of the countries we're at war with might even have a navy.

Labels: Afghanistan, Iraq, Utter Stupidity

Thursday, August 30, 2007

Must-Read Ranting from Mish

I believe Michael Shedlock misstates Ben Bernanke's conception of the causes and factors of the Depression, but Bernanke's nuances are not well served by his prose.

Unfortunately, the substance of the analysis is spot-on:

Bailing out the markets on options expiry open.... What's not to like about that? Taking risky collateral and being willing to roll it over forever.... What's not to like about that? (For more on this topic please see Now we know who and why.)

The short version of the second link is that Citigroup, JPMC, and BofA are all subsidizing their brokerage

His faith in Ron Paul and doubts about the function of the Federal Reserve are misplaced at best, but how can one object to a clear statement of reason:

No Mr. Bernanke, It's most assuredly NOT "worth considering at this juncture whether the private and public sectors, separately or in collaboration, could help the situation by developing a broader range of mortgage products which are appropriate for low-and moderate-income borrowers, including those seeking to refinance." [italics Mish's]

What Bernanke means by this is setting up a way for the bank to profit from your home's appreciation (if that ever happens again—which it will, some places). Apparently, the method that has been heavily used for the past six years—MEW and refinancing—has not made them enough money.

And Craig Newmark wondered why people wouldn't think BofA, with a dividend yield of 5.4%, is a buy.

Labels: Housing Bubble, Personal Finance Advice of Alan Greenspan

Hearts and F***ing Minds

A wire service article on the front page of today's Wisconsin State Journal bears the headline, "Military has non-lethal gun it could use to pacify Iraqis." [*] The "gun" in question is the Active Denial System, a directed-energy weapon.

Lest you get too hopeful, what the device does is heat the skin with bursts of electromagnetic energy, "causing a feeling similar to being on fire," according to a handy graphic accompanying the story.

Because nothing says "pacification" like the sensation of being burned alive!

A colleague chuckling mordantly over the article in the lunchroom suggested that the military might get better pacification results using the Mobile Cannabis Fogger.

[*] For those of you who don't click through, that's apparently a local concoction; the headline at the link is "Pentagon nixes ray gun weapon."

Can he really be that ignorant? Can he really be that thoughtless?

Yes.

This has been another MU version of "Simple Answers to Simple Questions."

The longer answer is that he's thoughtless and ignorant as a fox: he wants another tax cut.

The even longer answer, which I don't have the time or opportunity to research right now, is:

How many real economists have ever gone from arguing that everything is perfect to arguing for a 75bp rate cut in less than three months, especially if GDP for the previous quarter was 4% annually? And, if the answer is not the null set, were any of them ever correct?

Labels: Brad DeLong, Economics

Efficient Markets are Definitionally Suboptimal Resource Allocators

Mark Thoma demonstrates that this is necessarily true in basic economic theory, using "bubbles" as an example.

As Spencer notes in comments:

The problem is that this is the way the economy really works-- overshooting in one direction and over correcting in the other.

The problem is economic theory that never builds this into the mainstream models.

We teach the cob-web function in one lecture in intro-economics and then forget it. But the cob-web does a better job of explaining the system than the mainstream theory that academics teach.

It also implies that free markets are inherently much more wasteful than most economist like to believe.

Labels: Economics, free trade, Optimal Resources, teaching

The Plural of Anecdote: Housing Un- and Underemployment

Barry Ritholtz observes from recent renovations at his house that contractors are all of the sudden more available and more compliant. Fancy that!

We resemble those remarks. In a late phase of the work, a drywall contractor canceled on the scheduled morning due to a paperwork snafu. That they wouldn't have rectified that might run contrary to Barry's thesis (though it does not require that all contractors be twiddling their thumbs), but a more than suitable substitute was brought in on the same day. The HVAC contractor had been chomping at the bit throughout the project.

(A corollary of this post is that our house is construction-free for the first time in several months. You can see some pictures of the end result here, with before pictures in this post, if you're curious.)

We've also witnessed two layoffs due to the bust among our family and friends: one who worked for a subprime mortgage lender, and another who did high-end finish carpentry for super-McMansions. In the former case, there may be at least karmic benefits, as I'd heard a while back that the subprime loan terms made her want to scream "run away" to clients.

A casual survey of Edina, Minnesota during our recent trip seemed to show a steep, though not total, decline in high end building on spec. In my mother-in-law's immediate vicinity, where the sixties suburbia has been prime tear-down territory, one large house was rising on the lot vacated by what may have been (due to gross neglect) the cruddiest house in Edina. Three other high-end houses in the vicinity built on spec remained unsold since our last visit, roughly 90 days earlier, at prices ranging from $1.8 million to $3 million.

While a marketing flyer for another $1.8 million house (of mid-90s vintage) described the price as an "investment," the people across the street from my MIL — who had all but torn down the '60s walkout ranch that had been there and built an admittedly very nice '00s walkout ranch in its place, have so far turned a total "investment" of about $1.4 million into what area listings suggest might be an almost Irvine Housing Blog-worthy $1 million or so today. (N.B., Grandma does not live in a $1 million house.)

I guess big-buck LIBOR interst-only ARMs aren't available like they once were. It actually helps restore my world view a bit.

Labels: Housing Bubble

Wednesday, August 29, 2007

Fuel Economy "Sacrifices"

It's easy being (relatively) green in the forthcoming Audi A4:

The [new] three-litre diesel... develops 176 kW (240 bhp) and has a peak torque of no less than 500 Nm all the way from 1500 to 3000 rpm... [The B8 A4] needs only 6.1 seconds to accelerate to 100 km/h from a standing start, and has a top speed of 250 km/h, yet its average fuel consumption is a more than modest 6.9 l/100 km. The 3.0 TDI always has quattro permanent all-wheel drive.That's basically the same peak power that Americans got in the sainted BMW E36 M3, and essentially the same acceleration. Fuel economy for that car, with rear-wheel drive and a manual transmission, is in the ballpark of 25 MPG (combined urban and extra-urban). To do a rough metric conversion for you, that's 34 MPG (U.S. gallons) for the AWD A4 TDI. It's not that dirty, either:

The 3.0 TDI already complies with forthcoming Euro 5 limits. A novel exhaust gas recirculation concept with increased cooling performance is used to reduce emissions of oxides of nitrogen.The U.S. "Tier 2 Bin 5" standards are much stricter than Euro 5 on NOx emissions, but some of this generation of diesels can (and will) be federalized. Meanwhile, if greater fuel economy is the aim, a probably-not-for-U.S.-consumption A4 2.0 TDI with 143 bhp

has... peak torque of 320 Nm between 1750 and 2500 rpm – figures that explain why the new Audi A4 can accelerate from 0 to 100 km/h in 9.4 seconds and reach a top speed of 215 km/h. When combined with the six-speed manual gearbox, the [FWD] 2.0 TDI is content with an average fuel consumption of 5.5 l/100 km, in which case the 65-litre fuel tank provides an action radius of more than 1,100 kilometres.That's 43 MPG — headed towards Prius territory [*] — with much-better-than-Prius performance.

You might ask what you'd be willing to pay for the diesel's fuel savings. (See, for instance, the comments to this post, where commenter Mark R. suggests the Senate CAFE standards could be costly to consumers. GM's Robert Lutz suggests that the premium for a Tier 2 Bin 5 diesel could be in the $4,000-$4,500 range.) The current gas-powered 6-speed manual A4 3.2 FSI quattro gets about 22 MPG. For 12,000 miles/year of driving, the 3.0 TDI saves about 190 gallons of fuel annually. If the car lasts 10 years, the fuel savings are worth $4,800 in present value with a 4% discount rate and $3 fuel. I think the latter assumption is highly optimistic. Add just 4% annual fuel price increases, and the discounted savings increase to $5,700.

The savings are a bit less pronounced comparing FWD four-bangers (with the 1.8T gas engine turning in around 29 MPG with a manual), but are still in the range of $3,300-3,900 under the above assumptions.

So fuel savings from the vicinity of current U.S. car CAFE standards to that of the 35 MPG+ car standard passed by the Senate would pay for a lot of fuel-saving technology. Maybe diesels will give way to more advanced engines over the longer haul, or engineering hurdles with lithium-ion batteries will be surmounted to enable mass-producible plug-in hybrids sooner rather than later. But to suggest that you can't economically make 35 MPG with existing technology (let alone improvements between now and the Senate's unambitious 2020 implementation date) in a safe car with decent room and performance is just wrong.

[*] For real-world fuel economy. I've found the EU ratings, which tend to be more pessimistic than EPA city for the 'urban' loop and less than EPA highway for the extra-urban, to be pretty realistic overall.

Labels: Trains Planes and Automobiles

First Days of School

Today is the first day with both kids in preschool at the same time. John started yesterday, and with the big 0-5 coming up, is apparently Big Man in Lunch Bunch:

Julia's eagerness to get to school this morning outstripped the shutter speed (thanks in part to pre-rain overcast):

The first day's drop-off reportedly went without a hitch, which is not a given for the toddler class. Good job, sweet pea!

Tuesday, August 28, 2007

Dep't of Schadenfreude (Is There a Defense Attorney Good Enough to Get Larry Craig Off, and I Mean in the Criminal Defense Sense, Edition)

Josh Marshall is a little too kind to Sen. Craig:

With that assumption [that Craig's action would be readily recognizable as cruising for sex], it's still clear that the whole thing didn't get far enough for Craig to 'do' anything lewd...First of all, part of the cited behavior sounds pretty lewd to me. From the police report:

Given what's described, it seems quite possible that, with a good lawyer, Craig could have beaten the rap.

I [the arresting officer] could see Craig look through the crack in the door from his position. Craig would look down at his hands, "fidget" with his fingers, and then look through the crack into my stall again. Craig would repeat this cycle for about two minutes. I was able to see Craig's blue eyes as he looked into my stall.Maybe the angle is that Craig's eyes appear in his official portrait to be more gray than blue. Or not.

While Craig was cited for "lewd conduct," he was charged with disorderly conduct and "interference with privacy." See section 699.746 of the Minnesota Statutes, specifically 699.746(c):

A person is guilty of a gross misdemeanor who:It would seem reasonable to expect a degree of privacy in a public bathroom stall, and repeatedly looking in an occupied stall among other cited actions would seem to rise to an "intent to intrude," something which Scott Lemieux and Garance Franke-Ruta fail to grasp despite TNH's dispositive comment, "Because straight guys are forever gluing themselves to the cracks in bathroom-stall doors in order to stare for minutes on end at some other guy who's got his trousers down."

(1) surreptitiously gazes, stares, or peeps in the window or other aperture of a sleeping room in a hotel... a tanning booth, or other place where a reasonable person would have an expectation of privacy and has exposed or is likely to expose their intimate parts... or the clothing covering the immediate area of the intimate parts; and

(2) does so with intent to intrude upon or interfere with the privacy of the occupant.

Pace commentary about the supposed homophobia of the law, the case here is not, really, about the not generally criminal asking for sex — not that framing it so would exactly help un-dig Craig's particular hole. The peeping criminalized by the "interference with privacy" statute and the harassment covered by interconnected statutes isn't characteristically associated with gay men's behavior. And while there may be some circumstances in which an unwanted proposition should be handled with a polite if firm no, such things can reasonably considered nuisances, especially in highly public places like large hub airports.

Now, Craig pled guilty to disorderly conduct and the interference with privacy charge was dropped. Craig, trying to get on offense, has characterized the guilty plea as an overreaction. Yet it would not be better for him to go to court and lose. Plus, the plain language of the complaint suggests that, far from being caught in a Catch-22, Craig fashioned a very fine quality noose before hanging himself.

So the question is whether there's a plausible exculpatory account to be found via public bathroom behavioral norms. I might otherwise leave this to the restroom etiquette expert, but Dan's amusing posts on the subject are enough to suggest an answer subject to the operation of the intrablogiversal self-correction mechanism.

The short answer is: are you kidding me?

1. Non-cruising men's room behavior involves keeping at least some distance from strangers.

2. It isn't hard to tell when someone in an adjacent stall is using the toilet for excretory functions in the prompt fashion that airport bathrooms normally encourage by their ambiance.

3. Looking repeatedly into an occupied stall, and indeed looking more than once for longer than strictly needed to determine occupancy, is highly unusual.

4. Based on the sample of me and my colleagues, a bathroom "stance" wide enough to violate stall boundaries is rare in the U.S. male population. If seated, it's darn near impossible short of removing one's pants entirely, which would itself be highly suspicious among bathroom users past age 5 or so.

5. Part of what would seem to make the Northstar Crossing men's room a prime cruising spot is that it isn't a natural choice of bathroom for someone who's merely a harried business traveler. Those would be the facilities closest to the arrival and (if connecting) departure gates.

It's certainly not clear how retention of counsel would lead to a less embarrassing outcome.

Labels: Republican Party, Sex

Infrastructure Crimes of the Last Century

This is the historical marker for the late Minneapolis streetcar network at the Linden Hills station:

A Star Tribune website section (now seemingly vanished) on the Hiawatha LRT debut linked a 1954 story about the Great Progress represented by replacing those 523 miles of streetcar lines with modern diesel buses. As the era of cheap motoring ends to the point where just about everyone outside the Reason Foundation reconsiders how great automobile dependency is, this should lead to a costly do-over.

Labels: Trains Planes and Automobiles, West Wisconsin or East Dakota

Sunday, August 26, 2007

Brad Denton Explains Why Economic Analysis Alone is Not Enough

Brad Denton at Eat Our Brains, an excellent, social, cultural, and inadvertently-political novelist and brilliant short-story writer but so-so Do-It-Yourselfer analyses the Labor-Leisure Tradoff and the Substitution Effect in attempting to Maximize Utility:

Dear MHG: I don’t know. I’m supposed to be writing a novel. Won’t it be a better use of my time to work on the book and hire someone else to do the water-softener job?

Dear DIM: That depends. What kind of advance are you expecting?

Dear MHG: Okay, I’m ready to start on the water-softener project.

Read The Whole Thing.

Labels: Eat Our Brains, Economics, marginal utility, Optimal Resources

I Doubt this is Still True

While Tom is hanging out with senatorial candidates this weekend, I've been recovering from a productive work week.*

So, while I try to gear up again, this note from Tim Harford's Undercover Economist column** in the weekend FT caught my eye:

According to a credible 1990s estimate from the economist Daniel Levy, the typical American supermarket spent $100,000 a year changing the labels on its products: at high inflation rates it would have spent much more.

But would this still be true? One of the glories of the universal scanner technology is its ability to reduce the need for manual price changes on goods.

The corollary has been that stores have been "guaranteeing" that their scanned price will not be greater than the marked price. This is a labor-saving device: prices need not be marked on the goods themselves, but rather only on one or two signs for the shelf.

It does imply some other measures; for instance, "price checks" at the register may be more frequent. But the current effect of inflation on the cost of managing a supermarket undoubtedly should be lower than it was even in the 1990s. If it isn't, the fault lies with the management.

*My productivity appears not to have kept the firm at which I currently consult from laying off a significant number of people—and they have very little direct exposure to the U.S. mortgage market.

**Harford is one of those economists, like the sainted Coyle and the aggrandized Levitt, referenced in this post of Jeremy's as a:

popular economics [writer] [who] ha[s] created a stage in which another economist talking about how much of the world of interpersonal relationships and intrapersonal striving is not, in fact, like buying bananas at the supermarket can be called channeling one's Inner Economist, instead of, well, one's Humanity.

The column title, of course, is the same as the title of Harford's popularization effort.

Labels: Economics, technology

He's Good Enough, He's Smart Enough...

...and doggone it, he got his picture taken with a liberal blogger from Wisconsin.

More from the fair later.

Addendum from the Dark Side:

Here's Norm "There Must Have Been Long-Acting Psychedelic Substances in the St. Paul City Hall Water Cooler" Coleman's booth, which was a lonely place.

Based on that sign, Team Franken is way ahead in the graphic design race.

Meanwhile, at the Minnesota Republican Party booth, they had a straw poll on. Here are the results as of around 11:30 A.M. (click to embiggen):

The tally-taker's penmanship leaves something to be desired, but it looks like Ol' Basset Hound Fred was either commanding a plurality of the vote or at least neck-and-neck with Moneybags Mitt — who either didn't buy enough votes, or sent too few of his sons to stuff the ballot box. Meanwhile, the hardcore nutballs didn't seem to be going over that well with the Twin Cities crowd as they did in Iowa.

Labels: Politics, West Wisconsin or East Dakota

Saturday, August 25, 2007

Baseball Taxonomy, Kindergartener Edition

Quinn is obsessed with baseball. He's decided that he's going to be the third baseman for the Mariners when he grows up. We're encouraging this, of course, not only because of the thought of being kept in our old age in a style to which we haven't become accustomed, but because this option isn't really all that much less likely than his prior career choices: 3 (at age 2), a jack-o-lantern (at age 3), and the driver for the M&M [nas]car (at age 4).

At any rate, he spends a considerable amount of his considerable free time listing the teams. One of yesterday's lists was by mascot, and was broken down into five types: bird teams (Orioles, Blue Jays, Cardinals), fish teams (Devil Rays, Marlins), mammal teams (e.g., Cubs, Tigers), "people" or occupation teams (e.g., Mariners, Pirates, Brewers, etc.), and others (e.g., Reds, Rockies).

When he got to the Los Angeles Angels at Anaheim, or whatever they're called today, Quinn announced without hesitation, "oh, that's a fish team." I stifled a smile and gave myself a virtual pat on the back for a parenting job well done.

One wonders how he reconciles the halo on the team gear, not to mention the absence of any angelfish, with his world view.

Friday, August 24, 2007

The Ultimate Driving Machine...

...for the hedge fund manager's preschooler (assuming the fund hasn't blowed up!):

This 1/2-scale Auto Union Type C pedalcar is yours for $13,300, with 999 copies to be built.

Labels: Inequality, toys, Trains Planes and Automobiles

QOTD (With 'While I Was Out' Addendum)

Bradrocket:

God, can you imagine what Megan McArdle’s gonna be like when she has kids of her own and they ask her for lunch money?Meanwhile, an outer sociologist meets Tyler Cowen's inner economist and isn't so impressed.

“For that to be moral, the entire enormous class of school children who are hungry and unemployed must have some justified claim on the money of their working parents,” she’ll tell her weeping son.

To commenter Ralph Hitchens, you could find commentary on Freakonomics (e.g., Jeremy's) that acknowledged that some of the underlying real research was interesting without succumbing to the hype. I guess I was dissuaded from picking up Freakonomics by elements of what struck me as falsity in Stephen Dubner's original NYT magazine article on Levitt that serves as the enterprise's frame tale and/or creation myth. [*] Plus, Levitt very helpfully makes much of his research available online. Let me say that while I think the "freaks and geeks" critique of Levitt is unfair, I'd be interested to spy on a parallel universe in which Levitt, who professed, "I'm not good at math, I don't know a lot of econometrics, and I also don't know how to do theory," accordingly graduated from a 20th ranked PhD program.

As for Inner Economist, well, why buy the cow when I can gaze at my navel for free?

[*] For instance, "The average economist is known to wax oracularly about any and all monetary issues. But if you were to ask Levitt his opinion of some standard economic matter, he would probably swipe the hair from his eyes and plead ignorance."

Labels: Econoblogs, Economics, Glibertarianism

Housing Bubble: Out of One, the Many?

The mysterious knzn has a very interesting post up that makes a (quantitatively) simple but well-argued claim that a portion of the run-up in house prices that's been called the "housing bubble" can be linked to house-price fundamentals, namely changes in the value of the capitalized stream of shelter services [*]. Lest any sigh of relief emanate, the Thing to Note is that the path of prices detached from the fundamentals a couple years ago, and an unpleasantly large reduction in prices would be needed to reattach the two now.

One of the catches to this argument is that the maybe-not-so-bubbly-up-to-a-point national house price index is a composite of areas where prices inflated very rapidly — esp. certain big coastal cities — and many others that saw much more modest increases. This graph shows something of the spread of results by metropolitan area:

There is a similar, but much less pronounced, pattern in measured inflation in shelter costs:

The suggestion is that the low interest rates were the main "fundamental" driver. The low rates would be applicable more-or-less nationally, so they create a puzzle as to why lagging areas are so laggard. In some cases, there may be fairly obvious local strengths or weaknesses (see: metro Detroit, metro D.C.) but less so in others (e.g.: what accounts for the small lead Madison, with strong regional fundamentals, has over persistently depressed Syracuse).

There are also some key limitations to the OFHEO price data that limit its ability to measure the market's degree(s) of effervescence. Notably, it only counts transactions involving "conforming, conventional mortgages purchased or securitized by Fannie Mae or Freddie Mac." So it doesn't capture action in the markets for non-conforming and unconventional mortgages, which is a problem over a period where those are soaring as a fraction of the mortgage market.

So at the risk of handing out knzn or someone else with access to the relevant data some homework, what I'd like to see is that, for a broader set of transactions than the OFHEO base, and that prices and fundamentals track each other locally for bubblier and less-bubbly areas. Perhaps it's true, but I don't think it's been shown.

[*] In effect, and in something a little more like English, what you'd be willing to pay in a lump sum for the roof-over-head function of housing, in lieu of rental payments.

Labels: Economics, Housing Bubble

Wednesday, August 22, 2007

Internalizing Automobile Externalities: Mileage Charges or Fuel Taxes?

Ken (with a h/t to Peter Gordon) pointed me to a recent Journal of Economic Literature survey [*] on the external costs of motoring — i.e., costs not directly borne by motorists, including those related to pollution, congestion, accidents, and oil dependency — and possible policies to address them. A main conclusion is that most of the marginal external costs are mileage-related rather than directly fuel consumption-related, so it may be more efficient to institute charges based on the miles driven instead of by fuel taxes. As I explain below, this is not so obvious.

Gordon sarcastically notes that the 10 cent/mile estimate of the external costs is much lower than the 90 cents/mile he assumes in assessing the net costs of rail-based transit, which he regards as little more than a jobs program in most places. Wev. (Road building, being in most cases heavily subsidized by general tax revenues, may appear much the same.) Anyway, Parry et al. convert the 10 cents a mile into $2.10/gallon, of which only 40 cents is recovered by average U.S. gas taxes. Permanently add $1.70 to the price of gas and the result won't be a chorus of complaints that the U.S. offers too many mass transit options. Calculation of escape velocity for the collapsed remnant of the light truck market is left as an exercise for the reader.

Parry et al. are really jazzed about the idea of recovering the substantial accident-related costs via "pay as you drive" insurance, which is "emerging at the state level." Accident costs are strongly driven by miles traveled, but traditional insurance premiums are not. They cite a study that figures the premium for the average driver at 6 cents/mile. Actual premiums would adjust for individual- and vehicle-related risk factors.

The amount isn't totally unreasonable. As early-middle-aged Midwestern parents driving safe cars with clean driving records [**], and excluding coverage for damage to our own cars, we pay a bit more than 3 cents, which is the result of around 2 cents for the more heavily utilized car and 5.5 cents for the less-driven one.

What bugs me is the implicit alliance of the nanny state and the nanny corporation. Parry &c. note that "advances in electronic metering technology" make it "feasible to charge motorists on a per mile basis." Now, it's my understanding that automobiles have long been equipped with "odometers" that record vehicle mileage pretty accurately, and the data are even collected from time to time (e.g., when cars change hands). So what they're really talking about is liberating data that the cars already collect at much higher reading frequencies versus the current system. This doesn't necessarily require advances in electronic metering, but suppose it does.

Such a system would involve far more extensive data sniffing infrastructure than existing electronic toll-collection systems, since neither EZ-Pass-style transponders — i.e., not linked to the vehicle's computers — nor monitoring of a limited set of entry points would suffice. Electronic data collection costs would be a particular challenge for insurers, who have considerably lower customer densities than traditional meter-reading firms such as electric and gas utilities and (unlike utilities) can't count on the transponder being in any particular place at a given time. The bottom line is that government, probably via big-business contractors, would end up doing the data collection and sharing the results with interested parties.

Both government and insurers have interests in how, as well as how much, people drive; I'd expect agitation to mandate reporting of vehicle speed among other possible parameters. Plus, the systems will collect data on where cars were at various times. This may not be a big deal for a proto-panopticon country like the U.K. [***], but there remains at least the popular delusion in the U.S. that it's nobody's business where you legally go. All of this monitoring would be both expensive and have serious privacy implications.

So what of fuel taxes, which Parry et al. say may arguably have seen their "externality rationale" come and go? Well, they're strongly driven by vehicle mileage, for one thing. Vehicle fuel efficiency is related to vehicle mass and other characteristics that drive accident-related external costs — you want to get into an accident with a Honda Civic or a Ford Expedition? The entire fee-collection apparatus already exists, is visited regularly by all drivers, and doesn't care about when or where you drive. What's not to like?

Granted, increasing motoring taxes is not a political walk-in-the-park, but that's a function of the status quo. If the question is how to be charged the $1.70/gallon (or mileage-based equivalent), maybe we're better off with the devil we know and spending money on railroad track instead of roadway antennas.

[*] Ian Parry, Margaret Walls, and Winston Harrington, "Automobile Externalities and Policies," JEL vol. 45, 373-399.

[**] I.e., Americans who face relatively cheap car insurance rates.

[***] Though I gather that there is occasional civil disobedience.

Labels: Economics, externalities, Trains Planes and Automobiles

Tuesday, August 21, 2007

Not the QOTD

Adding to yesterday's extract, Nick Kristof again:

Mr. Cheney’s image seems to be of a dour stoic shivering in a cardigan in a frigid home, squinting under a dim light bulb, showering under a tiny trickle of (barely) solar-heated water, and then bicycling to work in the rain. If that’s the alternative, then many of us might be willing to see the oceans rise, whatever happens to Florida.Oh, ho ho ho. Now I partly resemble that remark, having taken this morning's ride to work (#70 since the snow melted in late March!) in just enough of a mist that I had a few droplets to wipe off my glasses. It also made the ride a bit more refreshing — soon to give way to bracing — which was good, since the good-for-almost-nothing office building's water heater was on the fritz this morning and the post-ride wash-up was extremely bracing and mercifully brief.

Now, I don't mean to suggest that you're a lazy sod if you, dear reader, don't occasionally bike or walk to work in the rain (though let's face it, it may not exactly kill you, either). The crazy thing, though, is that most people won't get out of their cars (or trucks) even for a three-mile commute in perfect weather — see Peter Gordon here — whether to save the planet, to save some amount of cash, or to arrest some spread of middle-aged backsides. When I'm feeling misanthropic, this factoid doesn't help my sometime view that we're not making a good case for ourselves that we shouldn't be allowed to go extinct. And don't get me started on the likes of Virginia Postrel spreading manure regarding energy-efficient lighting. (Style, maybe; substance, no.)

What actually surprises me is that one doesn't see more from traditionalist commentators to the effect that inability to endure a few drops of rain is contributing to the decline-and-fall of the culture. Forget Ma and Pa Ingalls and family surviving winter in Upper Midwest without modern utilities, just set the way-back machine to The Sad Story of Henry [1945], in which the big green engine's inability to endure a few drops of rain serves as a lesson in the evils of vanity and indolence. I suppose that the likely suspects either haven't transcended the need to Show the kids who bullied them in their youth with fast cars, or otherwise hope to transcend their mortal bodies.

Labels: Energy, environmentalism, Thomas the Frackin Tank Engine

More on the Short-Knickered Wall of Sound Guys and Economics

Turns out yesterday's "study" of that band was a paper done for a giggle.

John Whitehead (at the link above) quotes "the obvious response"("This is not much dumber than Levitt’s research.") but is careful to note that "the Freakonomics stuff is a serious study of behavior and incentives."

Monday, August 20, 2007

These are the ones that have working batteries, right?

With a hat tip to Paul Kedrosky's Infectious Greed, the value of that new iPod appears to have declined 20-25% since the end of the quarter.

Apparently, people are learning that the rumours about AT&T's lack of infrastructure are true. Or maybe it's just a side-effect of the 300-page and $5,000 iPhone bills.

At any rate, the discussion of that Aussie band with short pants and album production values to make Phil Spector proud is probably no longer visible.

Labels: Apple, iPod, technology

QOTD

McKinsey Global Institute's Diana Farrell, via Nick Kristof:

The sheer waste of it all [U.S. energy consumption patterns], when other countries have shown another path, is incredible. The opportunities here are tremendous.This would be quotable even if I didn't want to push frackin' AC/DC down the page...

Labels: Energy

Now we know WHY Economics don't talk about Economics

They have much more fun committing "Heavy Metal Heresy." (h/t Marginal Revolution)

As noted in the comments at MR:

And the conclusion that Brian Johnson is better than Bon Scott is, frankly, ridiculous. I don't deny that Johnson might yield higher efficiency ratings, but I would twist the conclusion around: the better singer is more likely to *distract* the listener from the transaction, and hence reduce efficiency.

Not only do the authors select a song covered by Pat Boone (track 3 of this album), they ignore the evidence of this film.

Next thing you know (you know what's coming), they'll decide that these singers are best of all, since people would prefer to ignore them:

Sunday, August 19, 2007

While I Was Out: The Ongoing Detroit Extinction Watch

Just before I saw this post by Ken, my brother told me that he'd picked up some Ford stock on the notions that it was relatively cheap at around $8 and that CEO Alan Mulally might bring half a clue to the place. He'd taken a similar gamble on Apple shortly after Steve Jobs's return, though — sadly for his future progeny — he unloaded his position with a gain, but one of a pre-iPod magnitude.

I mostly agreed with my brother, insofar as I'd been under the impression that Mulally's inclination was to raid the company's European product lines to field more marketable fuel-efficient cars with a low incremental investment. I'd be surprised if all of the three failed, and anyway between John Snow and Bob Nardelli, Cerberus-Chrysler looks to have cornered the market in reverse-alchemists.

Badmouthing the U.S. CAFE fuel economy standards doesn't necessarily change anything on that front, though it undercuts the only-Nixon-can-go-to-China credentials Mulally earned by admitting that global warming just might be real. [*] I suppose when you become a "Detroit Three" [**] executive, you get a chip implanted that automates the process.

Meanwhile, the automakers have been staging rallies trying to evince grassroots support for holding back the increase in automobile fuel efficiency standards recently passed by a large majority in the Senate. The Detroit News reported on an event in Chicago:

Workers held pre-printed signs, including "Don't be Fuelish. Save our Jobs!"Those of a certain age will recognize that some PR firm has inverted the meaning of the Ad Council slogan from the 1973 oil crisis into "please waste fuel." [***] Meanwhile, the automakers' ad agencies are desperately trying to sell such fuel economy as the Three's products offer. I can't help but think that the UAW's efforts would be better spent trying to organize foreign makers' U.S. plants.

Ken stole much of my potential thunder by re-making our long-standing point that only a moron would think that the Detroit Three's problem these days is that they're building too few trucks. One could ask why these workers weren't brandishing signs at their employers' Michigan HQs reading "Retool our factories. Save our jobs!"

For a lot of the anti-CAFE protesters, that is how their jobs will be saved. The effort, after all, is not to kill changes to CAFE outright, but rather to limit the changes to a less-aggressive set of standards that go a bit easier on trucks. I expect harsher discipline from The Market, since someone will have to discover a lot of cheaply extractable oil and/or keep the nascent Chinese middle classes out of cars for debates over a couple MPG in the 2020s not to look, in retrospect, like so much myopic wanking.

[*] On the subject of fuel taxation, Mulally's position is a bit more nuanced than Ken's post suggested:

"I just think it's so important that we all join in this debate and we really decide what we want to do about energy security and global warming," Mulally said "A piece of that could be a tax."I read that as trying (like Rep. Dingell) not to look obstructionist, and maybe even suckering a few Sensible Economists who like the idea of a gas tax and hate CAFE, by making a politically untenable policy the enemy of a good-enough one. Otherwise, Ken is right to imply that Mulally's policy preference amounts to advocating boiling in olive oil over boiling in canola oil.

[**] Now that they aren't the "Big Three," it must be a challenge to come up with a new term. Even "Detroit Three" has its issues, or at least had a big one under German ownership of Chrysler.

[***] While this is a deliberate inversion, I think some blogiversal terms of art would work better with different meanings. "Idiotarian," for instance, should be the term that describes economists to whom Dani Rodrik's "first-best" moniker gives too much credit (it's a secondary meaning, as indicated here, but seems mainly intended as a term of abuse directed at the left). Or take "Bush Derangement Syndrome," which should describe what Greg Mankiw must be suffering to carry water for Bushonomics even after he's no longer being paid to do so.

Labels: Trains Planes and Automobiles

Saturday, August 18, 2007

If Only I'd Heeded the Warning

Believe it or not, it's been three years since I staked this cyber-territory.

In line with my situational Luddism, I had regarded the nascent phenomenon of "Web logging" with suspicion, considering the extent to which the medium fosters one-handed typing of all sorts. (That is not totally irrational.) Then John arrived, and I found myself with long nighttime hours of post-nursing baby-settling time to kill. Since that reason for the loss of one typing hand was not conducive to the pastime, I started blogging just about 21 months later. The sleep deprivation-induced memory loss makes the interval seem a lot shorter than it sounds!

In the gestation period, my increasing blog-surfing convinced me for some reason that what the world needed was an economics version of Jeremy Freese's Weblog. (Remember, sleep deprivation! [*]) Then I spent some time contemplating whether to host the blog on the fee-based Typepad or the free-as-in-beer Blogger service. In the end, I figured the latter would be easier to explain to Suzanne, despite some unease from depending on a service with an inscrutable revenue model. In the end, that model was "sell out to Google," which has worked well enough for us. The rest of the secret to comparative blog longevity is avoiding the temptation to delete the blog in a funk or to hide from the occasional correspondent who wants to pray for the author's obviously damned soul. Regarding the former, I am grateful to Drek, Ken, and Kim for their contributions.

Jeremy recently located one of those Perfect Quotes from Robert Frank's Falling Behind:

The ultimate scarce resource in life is the willingness of other people to pay attention to us.Thanks to all of you who spend your scarce time here. Meanwhile, enjoy some virtual pie bites!

[*] Any failings of this blog are, of course, my own.

Postal Economics, Consumer Edition

As some of you know, I recently moved a year's supply and accumulation of Stuff across the country. Despite my best efforts to purge the library, this included 6 boxes of books, which I shipped via USPS' media mail at a cost of around $69. I didn't buy insurance, because (a) I didn't think about it and the clerk didn't mention it, and (b) even if I had thought of it, I generally decline offers to pay extra to insure myself against organizational incompetence.

The UPS ground rate for the same shipment would have been at least $180. I left the post office feeling pretty pleased with myself for saving $110, more or less.

Except...

USPS managed to lose 2 of the 6 boxes. Roughly a third of the contents of one of the two absent boxes appeared in a large envelope later, but of the remaining two thirds there is no sign. Assuming roughly equal weight per box, the total loss is a shade under a quarter of what we shipped.

Unfortunately, the missing books are all kids books, which are not only relatively expensive on a per pound basis but also have significant um, emotional value. In monetary terms, I'd guess the replacement costs will easily top $300, putting us around $200 in the red. In tear terms, much much more.

Worst of all, the Thomas the Really Annoying Tank Engine booklets survived. I'd pay extra for a USPS service that would make these disappear.

Note to Drek: fortunately, The Sandwalk Adventures also made the journey, so discussions of follicle mites' butts or lack thereof are still part of the household conversation.

Labels: just life

Friday, August 17, 2007

The best part of a voyage —

by plane,

By ship,

Or train—

Is when the trip is over and you are

Home again.

(Ludwig Bemelmans, Madeline and the Gypsies.)

Labels: just life, Trains Planes and Automobiles

Red Means Stop - Or, in this case, Cut the Engines!

It is now common knowledge that the Federal Reserve accepts three types of security for its Open Market Repurchase (and Reverse Repurchase) agreements: Treasuries, Agencies, and Mortgage-Backed Securities.

Generally, the security of choice is a Treasury. This week, though, Treasuries have been a very small portion. (Last Friday, all of the securities accepted for Repo were MBS.)

Above is the blend for the past three weeks of Treasuries, Agencies, and MBSes tendered by the market and accepted by the Fed. The red area at the top of each line (if it exists) is the MBS segment.

Rather speaks for itself, don't you think?

Labels: High Finance, liquidity, mortgage

A 33-year WAM is not sufficient to call it a "Money Market Fund"

Much fooforah yesterday about Sentinel's 33-year Weighted-Average Maturity "Money Market Fund." The record begins to straighten out:

Stocks fell after CNBC referred to Sentinel Management Group Inc.'s fund for commodity traders as a "money market mutual fund." In fact, the troubled fund is not a money market mutual fund and the distinction is very important.

Sentinel's fund is set up for pros, and was paying about 7 percent in interest to compensate commodities traders for the risks they were taking in it.

How Sentinel used to market it is another question.

How is Sentinel different from a money market mutual fund?

Most importantly, clients have immediate access to their cash, regardless of market conditions. (A mutual fund is allowed to postpone redemptions up to five business days in unstable market conditions.)

Second, through Sentinel, clients know exactly what they own. Sentinel sends daily emails (or faxes, if preferred) to each client reporting the total amount invested, the interest earned, and supporting securities. In contrast, mutual funds are typically sent statements on a monthly basis at most, and report assets owned by the fund only quarterly or semiannually, often two to three months following the reporting date.

If Sentinel is not a mutual fund manager, what is Sentinel's role?

Sentinel acts as an agent for its clients. Clients sign an Investment Management Agreement appointing Sentinel as a discretionary investment advisor to supervise and direct the investment of assets in the account on behalf of the client in accordance with the risk parameters agreed upon.

How frequently can I deposit or withdraw cash?

Sentinel clients can withdraw 100% of their cash daily. Sentinel accepts deposits of any amount daily. A cutoff time of 4:00PM (eastern time) applies for notification of intent to redeem or make deposits same day.

What if I don't need daily liquidity?

Clients who do not need daily liquidity for the entire amount of their investment can authorize Sentinel to invest for longer periods. This gives Sentinel the flexibility to seek slightly higher yields when the short-term yield curve is more steeply sloped.

The good news is that money market funds remain money market funds. The bad news follows in the next post.

Labels: High Finance, liquidity

The Fed approaches its senses

One of the silliest moves during the Bush administration was 2003's policy change that left the "Discount" rate higher than Federal Funds. (Discussed here; the short version is that any "moral hazard" was always mitigated by the transparency of the act itself.) Temporarily, they have seen the error of their ways, and taken a halfway measure of action:

To promote the restoration of orderly conditions in financial markets, the Federal Reserve Board approved temporary changes to its primary credit discount window facility. The Board approved a 50 basis point reduction in the primary credit rate to 5-3/4 percent, to narrow the spread between the primary credit rate and the Federal Open Market Committee’s target federal funds rate to 50 basis points.

Of course, they're also making it easier for firms that lack proper liquidity management to survive:

Board is also announcing a change to the Reserve Banks’ usual practices to allow the provision of term financing for as long as 30 days, renewable by the borrower. [emphasis mine]

This is, not to put too fine a point on it, a Monetary Policy Mistake. While providing emergency liquidity can be justified, this is simply a Revolving LoC to perpetuate poor management practices.

After 11 September 2001, the Fed made small business loans available to several NYC-area firms, loans that gave firms a chance to get their finances in order and back on their feet. But those loans were not renewable, and firms that could not adjust to the new market wound down anyway, as part of the "creative destruction" so feted by "free"-marketers. The effect of the loans was to make that destruction orderly, not to prevent it from happening.

Now, at 9:34 a.m., the immediate effect of the Discount Rate cut is that the stock market (Dow and NASDAQ) are massively up. To borrow a theme from The Sandwichman (at Max's Place), the idea that the "loan of last resort" is worth at least a 2.5% gain in the markets should in itself produce "a slight sense of unease."

Labels: Economics, Market Failures, monetary policy, Moral Hazard

Thursday, August 16, 2007

We're Number One!

Coutesy of my Loyal Reader, a piece from the Daily Mail on worker satisfaction in The City:

More than 80 per cent of Goldman employees were either happy or neutral about their jobs.

The firm that performed worst in the poll was troubled global investment bank Bear Stearns - more than 73 per cent of respondents who work at the firm said they were either dissatisfied or wished to leave.

It is notable that the Fixed Income side of the firm has been expanding significantly in London over the past eighteen months, including acquisition of a couple of mortgage-related firms.

The defence:

But Bear Stearns said: "We have a great record for employee retainment and feedback from our staff is generally very positive.

"We have a strong climate and are making a lot of top quality hires as we grow."

Of course, they said that about the recent acquistion of Encore Credit too. That's working out:

Bear Stearns gave 100 employees their walking papers yesterday, according to CNN Money. The cuts hit Bear’s subprime unit, Encore Credit. Headhunters say that more cuts are on the way thanks to the recent “meltdown” in financial markets....

With more to come?

Alan Johnson, managing director of Johnson Associates, a New York compensation consulting firm, expects layoffs in the mortgage and structured products divisions of the big banks before the end of the year.

There will be some good people available if that's true. But demand for those specific skills will probably be down.

UPDATE: BSRM takes a hit as well:

Encore Credit, based in Irvine, California, is eliminating 100 positions, and the Bear Stearns Residential Mortgage Corp. division in Scottsdale, Arizona, is reducing its workforce by 140, said the person, who declined to be identified because the number of jobs isn't being released publicly.

elicits the "non-defence":

"In the normal course of business Bear Stearns Residential Mortgage Corp. and Encore Credit evaluate market conditions and staffing levels in an effort to identify areas where we can eliminate redundancies and improve the efficiency of our operations," the New York-based firm said in an e-mailed statement today. "As a result we have made the decision to reduce our staffing levels and close two operation centers."

Encore was acquired late in 2006, with a significant number of their old staff electing severance instead of acquisition.

Can the EMC operations, centered in Dallas, be far behind?

Labels: High Finance, mortgage, subprime, The Old Firm

The New York Sun channels The Onion

But they're Serious:

The top American commander in Iraq is expected to tell Democrats in Congress part of what they want to hear next month when he briefs Washington on the status of the surge, namely that at some point American troop levels in Iraq will recede.

In September, when General David Petraeus will give classified and unclassified testimonies and recommendations to Congress, he will stress that unprecedented progress has been made against Al Qaeda and Iran's network in Iraq, lessening the need for the current troop levels of approximately 160,000. At the same time, the general will warn that any military progress made against America's foes will be lost if the surge ends precipitously.

So if Petraeus announces that the total troops will be cut to, say, 158,000, the Democrats win and can stop asking for a withdrawal plan, right?

Labels: Iraq

Chris Dillow Explains It All to You

Too good not to quote:

There's one very stupid way of doing this. Imagine you're a chicken. Every day, the farmer feeds you. After a while, you figure: "My returns from the farmer are pretty stable, as I seem to get roughly the same amount of corn every day. Being a chicken is a low-risk business."

The following day, the farmer breaks your neck.

Read the Whole Thing. After that, consider that Henry Paulson leaving his old job for his current one made both places worse.

Labels: High Finance, Optimal Resources, Statistics, subprime

Wednesday, August 15, 2007

"She Was Pitch-Perfect"

The first time I saw American Idol—2003, working in Charlotte, which hs no night life—was Fantasia's first appearance. Simon Cowell—who finds talent for a living, remember—just said outright, "You are the only singer we've heard who doesn't need this show."

He isn't quite that effusive here—possibly because the contestant on Britian's Got Talent is six years old:

BONUS VIDEO: Her performance at the final, which somehow she didn't win:

QOTD

Martin Wolf (via CR):

So capitalism is for poor people and socialism is for capitalists. This view is not just offensive. It is catastrophic.

Labels: High Finance

Tuesday, August 14, 2007

This is Usually Tom's Territory...

...and I hope he'll expand on it later. But I can't let this go by:

[Ford Motor Co. CEO Alan] Mulally said Corporate Average Fuel Economy, or CAFE, standards have done tremendous damage to the U.S. auto industry, without freeing the nation from its dependence on foreign oil or minimizing global warming.

"I have never seen a market-distorting policy like CAFE," Mulally said. "It's a policy that forces you to put out more small cars than there is consumer demand for to make the bigger cars that people really do want. You're trying to force the market instead of being market-driven."

Yep. That was the problem; they haven't been making enough trucks because they had to make those pesky small cars.

That's why Europe, South America, and Mazda were all profitable in Q1. (I'm not cherry-picking; all areas were profitable Q2.)

Mulally's solution, by the way, is to increase the gas tax so people choose to buy all those European and South American cars that they don't sell here anyway.

Labels: Economics, Pigouvian tax, Trains Planes and Automobiles

A Good Time Was Had By All

Even though I've been doing this blogging thing for almost three years [*], in some respects I feel like (or at least like to feel like I feel like) a Twentieth Century Boy. I regret, for instance, the demise of postal letters as a communications medium — not that I'm actually writing them these days. And I've preferred to take my computer strategy games single-player, rather than wage global thermonuclear war with friends or wander around Second Life with an Ivy League professor avatar. [**] For reasons like these or possibly others, it does seem to surprise a lot of people that I gave Ken, Kim, and Drek keys to the blog despite knowing them only from blog-related interactions and a smidgen of also-blog-related side chatter via e-mail.

Anyway, that anomaly has been eliminated as Suzanne and I used the conjunction of the sociology meetings with our annual summer visit to the East Coast to meet the whole lot of them, plus Tina [***], Drek's Sainted Fiancée, and Ken's wife Shira. So what were they like? Pretty much as I'd have expected, as it turns out. As for what those expecations were, well, that would be telling. But three cheers to Teh Intertubes for putting us in touch with them all. I could not ask for a better bunch of blog pals.

[*] The third blogiversary is Saturday. There will be pie bites to mark the occasion.

[**] The single-player game challenge, reverse engineering the AI players' behavior, should be understood as a form of recreation distinct from the multiplayer experiences.

[***] Also a co-blogger via Total Drek, she is now also blogging here.

Labels: just life, Meta, Realities Virtual and Otherwise

Blogs are Why I Don't Need to Write Book Reviews So Often

Felix Salmon posts a capsule description of Freakonomics:

[I]t's a largely substance-free hagiography of a highly respected Chicago economist, padded out with vast amounts of unreadable data, and liberally sprinkled with disingenuous and hidden agendas.

So instead of the hundreds of words I would have had to write, I can write four: What Felix Salmon Said.

For his full-length piece, see here.

Labels: cult of personality, Economics

Random Note

When last seen, Tom and Suzanne were in the waiting area at Penn Station, hoping to catch the 9:05 train to Delaware, on which they had reserved seats.

They were last seen at 9:30, when our train to the wilds of New Jersey announced it was boarding. (It in turn was delayed about fifteen minutes in the station; one hopes it was to allow their train to leave first.)

We trust that they did not end up spending the night in Penn Station.

In other news, Chris Dillow of Stumbling and Mumbling notes the one question one should not ask an economist. I can safely say that I didn't ask it of Tom; whether Kim or Drek did is left for them to explain.

Monday, August 13, 2007

This is What They Mean by "Thin Client"

I go onto the web to find a restaurant (whose name I have forgotten) for dinner tonight for Tom, Suzanne, Shira, and me. As with many NYC restaurants, it accepts online reservations.

After clicking submit—but well before the window completes posting the data (I think)—I remember that I cannot check my (home) e-mail to verify that everything is fine. I close the window in haste and pick up the telephone.

Ken: "Hi. I, er, started to, uh, make a reservation online but, well, I, uh, don't know...."

Gracious Hostess: "You're not certain you made a reservation online. What's your name?"

Ken: "Houghton"

GH (perkily): "It's right here."

Labels: just life, technology

"Here's a Xmas Dinner for the Families on Relief"

Tanta at CR excerpts this gem:

The holiday season in Cordell, Oklahoma, did not start off on a merry note back in 1987. Just a month shy of Christmas, Farmers National Bank of Cordell failed...

At Farmers’ closing, FDIC staff noticed an asset labeled “turkeys” on the bank’s books. When asked about the entry, bank employees directed the FDIC staff to a cold storage locker filled with frozen turkeys—literally thousands of them. The records about the turkeys’ ownership were incomplete, but bank employees assured the FDIC that the turkeys had been repossessed....

With the holidays drawing closer, the FDIC staff decided to spread some good cheer by donating the turkeys to a homeless shelter and food pantry in Oklahoma City. Christmas was certainly much brighter for many homeless people that year.

Somewhere, that year at least, Pretty Boy Floyd was smiling.

Sunday, August 12, 2007

Yankees Update (fifth in a series)

The team is now fifteen full games over .500 (66-51), has broken Scott's heart, and looks to be a lock for the playoffs (they need to finish the season with a better record than two of

But, going back to the original motivation for talking about the Yankees [April 10th], the predicted 110 wins seems safely impossible. Even after beating up on the bottom of the league and continuing winning, it is likely that some time this week, the prediction will be officially impossible.

Games Left 45

Need to Win 110

Have Won 66

Remaining Wins 44

Winning Pct Required 97.8%

One more loss, in other words. But what about the betting line at the beginning of the season?

Games Left 45

Expected Wins (Season Start) 97.5

Need to Win 31.5

Winning Pct Required 70.0%

Doesn't seem impossible, even though the team that has a losing record against both the East and West AL divisions. (They were two games over in Interleague play, and are 23-7 against the Central.) But it remains Not the Way to Bet—and, despite the recent streak, it's a more difficult requirement than it was when I ran the June 16th update.

(For completists, here are post two [April 24th] and post three [May 29th]. I can only attribute skipping July to more important sports and activities.)

Labels: baseball, sabremetrics, Yankees

Time-Shifted "Events"

We watched High School Musical 2 last night. (Well, the Eldest Daughter did. I got bored fairly quickly.)

The above is not a typo, but note the IMDB Tagline:

On August 17th, are you ready for the start of something new? [emphasis mine]

The movie is available now at Disney Channel On Demand.

The same is true of Californication, the new Showtime series starring David Duchovny as (I gather) a less-scrupled version of Dustin Hoffman in Kramer v. Kramer (instead of just a naked Jo Beth Williams, there will be many naked women, as Duchovny "tries to juggle...his appetite for beautiful women."

I don't know how many balls Duchovny will have in the air Monday night, when the series officially premieres. I'll probably find out from when Mannion's posts (assuming the man ever finishes Year 7: Harry Potter and the Deathly Hallows.

But I wonder what impact leaking the two shows, both heavily advertised, will have on their ratings. (This is especially true in the case of the Disney movie, where the commercials that are not present On Demand will give many people the chance to opt out before the end.)

And what happens if my daughter goes to gymnastics camp tomorrow and tells people about the movie? The greater the contagion, the more likely the effect. And the more clear it will be that the incentives are mis-aligned.

Of course, On Demand isn't perfect. I'm still going to have to wait for Meadowlands to air before it become available that way. (That show is Mannion's fault as well, and I thank him for it occasionally.) But if the mode of the future is On Demand before Scheduled Broadcast, will the Social Network become more On Demand and less Branding?

Saturday, August 11, 2007

The Standard Rule always applies

Warren Buffet is fond of noting that when a good manager joins a bad company, it's likely that the manager's reputation, not the company's, will change. (A simplified version is here.)

Apparently, good credits put into bad houses find the same effect. Or, as Tanta put it:

Insofar as FICOs are accurate measures of past performance, high scores indicate borrowers who have managed credit wisely in the past. Put those borrowers in unwise credit terms, and they perform just like people who have managed credit unwisely in the past. Glad we got some real-time empirical data to prove that. Sorry about your global financial crisis.

Labels: Housing Bubble, Moral Hazard, mortgage

Friday, August 10, 2007

Mark to Model -- Singular

There has been much discussion (often heated enough to cover Tom's household energy needs) about "marking to model." (Tanta at CR has been especially good on this issue.)

I have no conceptual problem with marking to model so long as (1) actual trading prices are not significantly different from the model and (2) the model used is consistent.

Apparently, the SEC is starting to share that last concern:

U.S. regulators are scrutinizing the books of Wall Street's largest investment banks amid questions they are hiding losses from subprime mortgages, people familiar with the inquiry said.

The Securities and Exchange Commission wants to see whether firms are calculating the value of subprime-mortgage assets on their books the same way they calculate those values for their brokerage clients, such as hedge funds.

Note that the same method doesn't require the same price. But especially assets that are Held for Sale (HFS) are supposed to be marked with the best information available. This may not have been happening:

Wall Street banks are in a sensitive period as turmoil in U.S. mortgage markets generate losses for investors and push some lenders into bankruptcy. Yet few investment banks have disclosed significant subprime losses in recent periods.

The scrutiny may also help pinpoint whether hedge funds accurately report their results to investors, the Journal reported, citing an unnamed source. Regulatory checks into how firms calculate values of certain assets could boost the accuracy of performance reports to investors. [emphasis mine]

The first rule of reporting losses is that you can survive if you detail the entire problem upfront. If you report an $8 million loss the first day and $4 million more the next, you'll run into more problems than if you report $12 million on Day 1.

Liquidity and Transparency: they're not just for text books any more.

Labels: hedge funds, High Finance, Moral Hazard, Personal Finance Advice of Alan Greenspan, principal/agent problems, subprime

But what do they think of TtfTE?

Via Reuters, (h/t Marc Andreessen):

For every hour per day spent watching baby DVDs and videos, infants aged 8 to 16 months understood an average of six to eight fewer words than babies who did not watch them, Frederick Zimmerman of the University of Washington and colleagues found.

The lump of labour specificity raises its head in a second post today:

"The results surprised us, but they make sense. There are only a fixed number of hours that young babies are awake and alert," said Andrew Meltzoff, a psychologist who worked on the study.

"If the 'alert time' is spent in front of DVDs and TV, instead of with people speaking in 'parentese'-- that melodic speech we use with little ones -- the babies are not getting the same linguistic experience," Meltzoff added....

"Old kids may be different, but the youngest babies seem to learn language best from people."

This implies:

Dr. Dimitri Christakis, a pediatrician at Seattle Children's Hospital Research Institute who worked on the study, said parents frequently asked him about the value of such videos.

"The evidence is mounting that they are of no value and may in fact be harmful," Christakis said.

And just this year, the State of the Union cited Baby Einstein founder Julie Aigner-Clark as "represent[ing] the great enterprising spirit of America."

Damn the consequences, full steam ahead!

Labels: Bushonomics, education, human capital, Kids

We Told You So...

In the grand tradition of this post by Dr. Black, we remind regular readers that this blog warned people in early March that the U.S. mortgage apocalypse [was] nigh.

Would rather be wrong about that.

Because Neil Gaiman novels are less utile than Neil Gaiman movies?

Without this:

This would not be in theaters today.

So what are John Scalzi and Brad DeLong thinking when they tell us to go TODAY, so that Neil will write more film scripts and—because "lump of labour" discussions are legitimate regarding the Gaiman singularity—fewer books?

Don't get me wrong; we're going tonight. And it seems unlikely that Gaiman—whose novel Coraline has been filmed (is in post-production) and was a screenwriter the upcoming Beowulf film—is going to get thrown out of Hollywood any time soon.

But do we really want Gaiman to have less time to write novels?

Labels: Brad DeLong, lump of labor, movies, sf

Everything's Gone Green

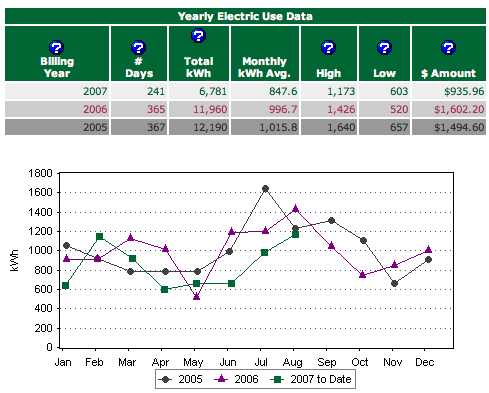

I wouldn't usually consider a letter telling me my electricity bill was going up to be good news, but yesterday's mail brought word that we've reached the front of Madison Gas & Electric's wind power queue and our electricity usage is now 100% wind power, for 2.68 cents/KWh over the regular 13-cent rate.

We had prepared for this by installing energy-efficient lighting throughout the house and eliminating the need for electric space heat [*], so that the price increase should be washed by reduced usage. The fruits of the effort are already visible in our use history, which MGE conveniently makes available on Teh Intertubes:

In fact, the letter adds that a proposed expansion of MGE's renewables program would reduce the clean power price premium to only one cent/KWh. [**] Fans of Jim Kunstler [***] might note that the issue with renewable energy is not price but the quantity that can be supplied. While cool breakthrough technologies such as cheap nanotech photovoltaics may help (maybe a lot), it shouldn't be forgotten that many electrons go to waste, with residential lighting, vampiric home electronics, and bottom-feeding office PCs among the notable offenders. Knocking 10% off of residential electricity demand won't save the world, for sure, but it (a) can't hurt and (b) is within the realm of the effectively free.

[*] This was partly via a no-cost reassignment of bedrooms, and partly via installation of a radiant heating system whose payback will be measured in utils, not dollars.

[**] To the possible objection that the one cent premium is subsidized, I note that the non-renewable power doesn't pay its external costs, given our coal-centric conventional generation.

[***] I'd count myself as one, though I don't agree with him all the time. (E.g.)

Labels: Energy, environmentalism, just life

Thursday, August 09, 2007

The Anti-Midas Touch

He has some sense of timing, that WPE!

Bonus Bushism from the presser:

Another factor one has got to look at is the amount of liquidity in the system. In other words, is there enough liquidity to enable markets to be able to correct? And I am told there is enough liquidity in the system to enable markets to correct.Or, 'someone said "liquidity" in the briefing, and I'm using my Harvard MBA training to

use it in sentences!'

Labels: Bushonomics

And a Fine Unpacking It Is

Go read Kathryn Cramer's excerpts and commentary from SciAm's defence of science fiction. Sample:

Maddox asks, "Why are they not holding their annual meetings in some sort of gilded purpose-built pyramid while humanity waits breathlessly outside to receive their inklings into our future?" That's Hollywood, dear. We're book people, and not rich book people like the techno-thriller writers.

But if you want that sort of venue, try the Science Fiction Hall of Fame inductions held in the Sky Church of the Experience Music Project, which was built with Paul Allen's money. I'm not sure this would satisfy, though: Charlie Brown, a former nuclear engineer, would still be around in a Hawaiian shirt picking over the hors d’œuvres.

Labels: sf

Wednesday, August 08, 2007

Just a Baseball Note

I was thinking about updating the Yankees, but instead, I want to review Barry Bonds's last three home runs:

- Number 755 (ties Aaron): Giants trail San Diego 1-0 as Bonds hits an opposite-field line drive out of the park to tie the game. (Giants end up losing)

- Number 756 (breaks tie): Giants and Nationals are tied at 2-2, 1 out, no one on. Bonds homers to give the Giants the lead. (Giants end up losing.)

- Number 757: Bottom of the first, man on. Bonds homers to make it 2-0. (

Game still in progressUPDATE: Game-winning hit.)

I've been watching Barry Bonds hit for around 20 years. He is, if anything, better with his bat than the last time I remember seeing him live (an opposite-field fly ball to deep right-center that ended the 1990 playoffs at Riverfront). And, with due respects to the doubters, you don't get that from steroids. You get injuries and breakdowns (op. cit. Canseco, Giambi, McGwire), not the best producing NL left fielder at the age of 42/43.

UPDATE: See also Mark Cuban.

Now I'm going back to listening to this Bee Gees concert at Wolfgang's Vault.

Labels: baseball

Hoisted from Comments: This is a Defense?

Arnold Kling responds via comment to Ken's post:

I disagree with your interpretation of my essay. I did not say that getting screened for colon cancer is a bad idea. I just said that it is not a human right. I did not say that clinical trials are a bad idea. I just said that undergoing a therapy that is just in the clinical trial stage is not a human right.Going to the replay, Kling said:

But none of these medical services [diagnosis of a back injury, colonoscopy, experimental treatments] is a necessity. You would not say that someone's human rights were violated if they did not obtain these services.The problem is that neither "necessity" nor "human rights" is defined. He might as well say:

But none of these medical services is a blimlimlim. You would not say that someone's dalg glidj were violated if they did not obtain these services.I mean, who could argue with that? [*]

Since actually "necessity" and "human rights" aren't (or at least shouldn't) be nonsense words, we can argue. At EconLog, it can be hard to find a "right" that's defended beyond the "inalienable right to the fruits of [one's] labor." [**] Even on that score, Kling is on thin ice. He grants that colonoscopies "may be a helpful precaution against colon cancer" seemingly without recognizing that "helpful" means "preventing untimely death," which is the ultimate alienation of property, and I don't mean by terrestrial taxation. (Also, the age and frequency recommendations for colon cancer screening already involve some cost-benefit calculations, raising another question of just what Kling considers "cost-effective health care.") Diagnosis of back injuries can mean the difference between the ability to work and the ability to collect a disability stipend.

The care may not be "necessary" in a guarantee-of-success sense, but nevertheless there's a clear nexus betwen health status, health care, and the Lockean rights that Cato Institute libertarians may like to claim.

Kling continues:

As to uninsured children, if they are orphans then certainly it makes sense for the government to insure them. Otherwise, their families have the primary responsibility for paying for their health care. I stand by my position.I stand by Kling's "right" to stand by his position [***], but this doesn't do much to rebut Ken's claim that libertarianism run amok makes people think (some) economists are bonkers.

Surely, you might say, someone with a PhD in economics from MIT (as has Kling) must be aware that there's some middle ground between "orphans" and children of better-off parents who voluntarily self-insure (if any). Not so fast! Kling was a perpetrator of one of those "the poor never had it so good" arguments you see every once in a while, including (I sh1t you not) a subhead "The Disappearing Lower Class." [****] That once led me to offer what I now might call "Shorter supporters of the bankruptcy bill:"

The poor and working classes aren't poor because they have access to better cars, occasional air travel, VCRs, microwave ovens, and washing machines. However, they shouldn't have spent their (or their creditors') money on any of it.Or, if you want to think of the issue in such terms, both household budget constraints and relative prices partly why the relatively poor can enjoy some modest amenities of millennial technology while lacking in health insurance and/or routine health care.

You can add up everything a not-that-well-off family spends on modern conveniences and not come close to the price of a health plan that covers preventive care. In such cases, which I submit without proof are not uncommon among the uninsured and underinsured, there isn't a real choice at hand.

Or, if people "choose" to consume preventive health care at inefficiently low levels but will respond to prices, then they have to have a lower price put in front of them to fix whatever incentive problem there might be. This is, perhaps not surprisingly, the opposite of what most "market-based" health care "reforms" would do — i.e., raise effective prices of certain health care services in hopes that people consume less.

Believe it or not, Kling's comment here is a less crass formulation of his argument than what he offers on his own blog:

But are those children all orphans? If not, then I think that their parents can be held responsible for paying for their health care. If the parents choose not to buy health insurance, then they may have to pay cash or take out a loan to pay for medical services...

It strikes me that the advocates of expanding SCHIP, the Federal program that covers children, have successfully framed the issue as if the children were all orphans. This ought to go down as one of history's finest achievements in demagoguery.

This may go over swimmingly at the Cato or Club for Growth water coolers, but in the rest of the world, "that'll learn their parents to be more responsible" isn't the first thought (perhaps even in wingnuttier districts) when a kid who has chosen his or her parents badly gets sick.

[*] Apologies to the estates of Margaret and H.A. Rey. I actually don't argue with Kling in regard to the right to experimental or unproven treatment, but that's a plastic apple mixed in with edible oranges in his post.

[**] Which, to steal a phrase from Stephen Pinker, "would have been unthinkable throughout most of human history," and remains totally impractical today.

[***] It gives us stuff to blog about, if nothing else.

[****] They could be said to "disappear," after a fashion, if one can limit one's routine to the libertarian paradises of upper-middlebrow suburbia.

Labels: Economics, Glibertarianism, Health Care