Wednesday, April 02, 2008

Don't Say You Didn't Get Anything From the Bailout

by Tom Bozzo

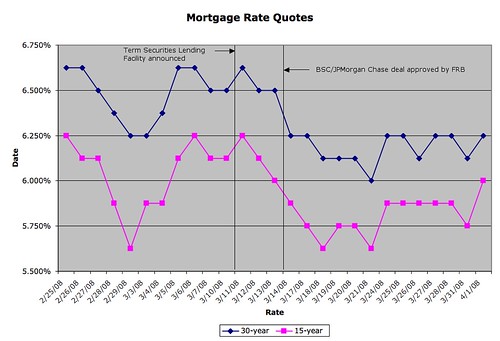

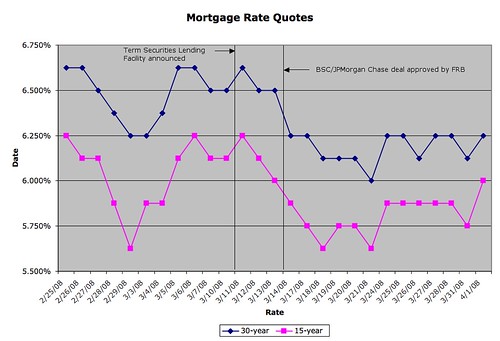

I've shown the FRB announcements of the Term Securities Lending Facility and of the approval of the BSC/JPMorgan Chase deal. Particularly after the latter, the 30-year rates (on a zero-point cash-out refi with 80% LTV) appear to have dropped around 37.5 bp from the previous range; let's call the sustained drop for someone who can afford a 15-year amortization 25 bp. So there's a little something for Main Street, though these rates aren't near the historic lows that are sometimes credited as a "fundamental" factor behind the house price run-up (in my not-so-extended family, there's at least one 15-year mortgage where the first digit of the rate is a 4).

Whether this will turn out to be worth more to the public than MBS losses flowing through the Fed to the Treasury remains to be seen.

Here's another update to a recent post, in which I sought to figure out what was in the recent efforts by out monetary policymakers to deal with the housing troubles for me — relatively responsible borrower who still (probably) has a fair amount of home equity. Initially, the answer seemed to be Sod All, but that's changed a little, as you can see from the updated graph:

I've shown the FRB announcements of the Term Securities Lending Facility and of the approval of the BSC/JPMorgan Chase deal. Particularly after the latter, the 30-year rates (on a zero-point cash-out refi with 80% LTV) appear to have dropped around 37.5 bp from the previous range; let's call the sustained drop for someone who can afford a 15-year amortization 25 bp. So there's a little something for Main Street, though these rates aren't near the historic lows that are sometimes credited as a "fundamental" factor behind the house price run-up (in my not-so-extended family, there's at least one 15-year mortgage where the first digit of the rate is a 4).

Whether this will turn out to be worth more to the public than MBS losses flowing through the Fed to the Treasury remains to be seen.

Labels: High Finance, monetary policy, Personal Finance Advice of Alan Greenspan